When you’re planning promotions, the choice between broad SF toothbrush deals (online and regional digital discounts) and an on-the-ground San Francisco sale (local in-store events, pop-ups, and city-focused campaigns) matters for margin, logistics and brand perception. Each approach reaches different buyer intents and offers distinct operational trade-offs — so B2B buyers and OEM partners should evaluate both against KPIs like sell-through, new-account acquisition, return rates and lifetime value.

First, consider how customers find your product. SF toothbrush deals that run on marketplaces, retailer websites, and social ads capture both local buyers and tourists researching before arrival — often at a lower acquisition cost per click. In contrast, a San Francisco sale (mall pop-ups, neighborhood store promos, or tourism-area kiosks) targets immediate foot traffic and impulse purchases. Therefore:

Promotional depth affects both sales velocity and brand perception. Heavy, repeated SF toothbrush deals on third-party platforms typically compress margin but move large inventory quickly. A San Francisco sale can support gentler discounting (or value-add bundles) because customers expect event premiums for convenience and immediacy. Practically:

-300x300.jpg)

-300x300.jpg)

Operationally, online SF toothbrush deals require robust fulfillment: fast shipping, clear return policies, and capacity to handle spikes. Returns and RMAs can be higher when customers buy sight-unseen. Conversely, San Francisco sale events reduce online returns because customers inspect product in person, but they introduce pop-up logistics (temporary storage, local staffing, permits). For B2B partners:

An ongoing stream of SF toothbrush deals can drive repeat purchases (subscription upsell) if paired with CRM and retargeting. However, a memorable San Francisco sale—especially co-branded with local clinics, hotels, or tourist services—builds face-to-face trust and can open wholesale relationships with local retailers and hospitality chains. Use this playbook:

Don’t overlook regulatory and calendar factors. San Francisco permitting, sales tax collection, and health code requirements (for amenity kits sold to hotels) add friction to a San Francisco sale but can be managed with local partners. Similarly, for SF toothbrush deals plan around peak windows (holiday travel, trade shows, back-to-school) and ensure ad creatives and claims comply with advertising and health rules. Practical tips:

Decide success metrics before launch. Typical B2B KPIs include:

If your objective is volume and measurable digital growth, well-targeted SF toothbrush deals (with solid fulfillment and subscription hooks) will generally outperform a single local activation. However, if you need brand credibility, retail placements, or immediate in-market presence—especially in tourism-heavy neighborhoods—a carefully executed San Francisco sale can deliver higher-quality customers and lower returns. Best practice for B2B partners: blend both. Use digital deals to create awareness and capture demand; reinforce with periodic San Francisco on-ground events to convert, demo and build local retail relationships.

If you’d like, I can convert this into a one-page decision matrix (promo type vs. KPI) or draft a sample campaign calendar that sequences SF toothbrush deals and San Francisco sale activations for maximal ROI. Which would help your team most? Contact us

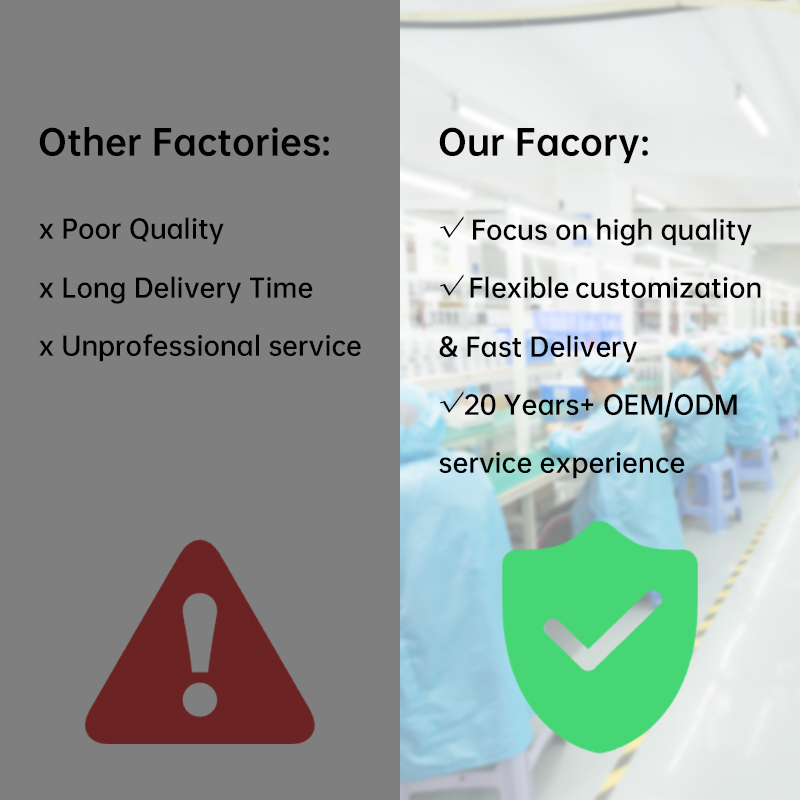

Looking for Toothbrush OEM Manufacturing Services with Custom Toothbrush Branding Capabilities?

.jpg)

sonic electric toothbrush Tacoma

7 Reasons to Start Your Electric Toothbrush Business in 2023

The Hidden Engine for Your Oral Care Brand’s Growth

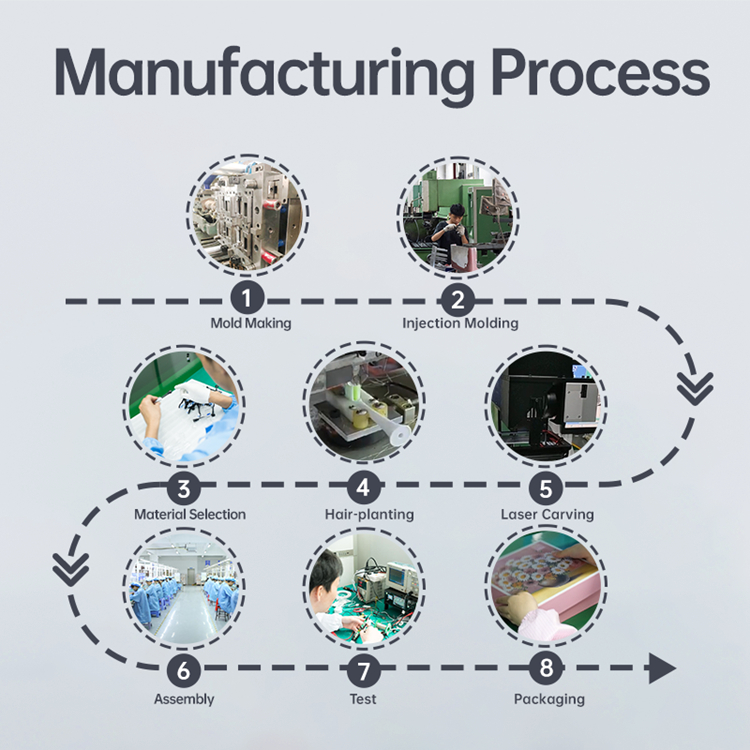

Electric Toothbrush Manufacturing Process

What types of batteries are currently available for electric toothbrushes?

How to Make Your Own Electric Toothbrush

The Importance of Dust-Free Workshop in Oral Care Product Manufacturing

Texas Tax-Free Weekend Electric Toothbrush Wholesale Guide 2025

How much does it cost to manufacture a toothbrush?

Electric Toothbrush with Replaceable Heads – Cost-Effective and Sustainable B2B Oral Care Solution

Professional-Grade Electric Toothbrush for Clinics – Reliable OEM Equipment for Dental Practices

The Truth About Blue Light Whitening in OEM Electric Toothbrushes

Protect Your Brand: Manufacturers Reveal Which Brush Heads to Stop Using Now

.jpg)

Dallas Electric Toothbrush Private Label Services Including Custom Packaging

Pressure-Sensitive Electric Toothbrush Suppliers for Dental Chains

Electric toothbrush heads Charcoal Infused-Diamond

electric toothbrush heads Regular Clean

electric toothbrush heads Deep Clean

Private Label Whitening Gel

electric toothbrush heads Charcoal Infuse-Round

electric toothbrush heads Ultra Soft

Customization Teeth Whitening Gel

.jpg)

Florida Electric Toothbrush – Powsmart PTR-C8

whstapp

whstapp

National Toll-Free Service Hotline

+86 755 86238638